florida estate tax limit

TAMPA -- The 2022 limit for assessment value increases of Homestead property has been released by the Florida. The florida constitution prohibits inheritance taxes.

The Complete Guide To Florida Probate 2022 Florida Probate Blog January 2 2022

Ad Import tax data online in no time with our easy to use simple tax software.

. The Florida Constitution was amended effective January 1 1995 to limit annual increases in assessed value of property with Homestead Exemption to three percent 3 or the. Ad Contact Mariner Wealth Advisors for assistance in making this transition. The Tax Cuts and Jobs Act raised the lifetime gift and estate tax exemption to 117 million for 2021 and 1206 million in 2022.

The 2021 tax year limit or the amount limit in 2022 after adjusting for inflation is 1206 million up from 117 million in 2021. Florida estate tax limit. This could include cash real estate retirement accounts or a range of other assets.

The Florida Constitution was amended effective January 1 1995 to limit annual increases in assessed value of property with Homestead Exemption to three percent 3 or. Ad From Fisher Investments 40 years managing money and helping thousands of families. File your taxes stress-free online with TaxAct.

Florida DOR caps assessed value of Homestead properties. Florida Property Tax Valuation and Income Limitation Rates see s. Due by tax day April 18 in 2022 of the year following the individuals death.

Cell 813 955-2526TAMPA -- The 2022 limit for assessment value. Download our checklist to learn about establishing a domicile in a tax-advantaged state. Estate in Florida with a just value less than 250000 as determined in the first tax year that the owner applies and is eligible for the exemption and who has maintained permanent residence.

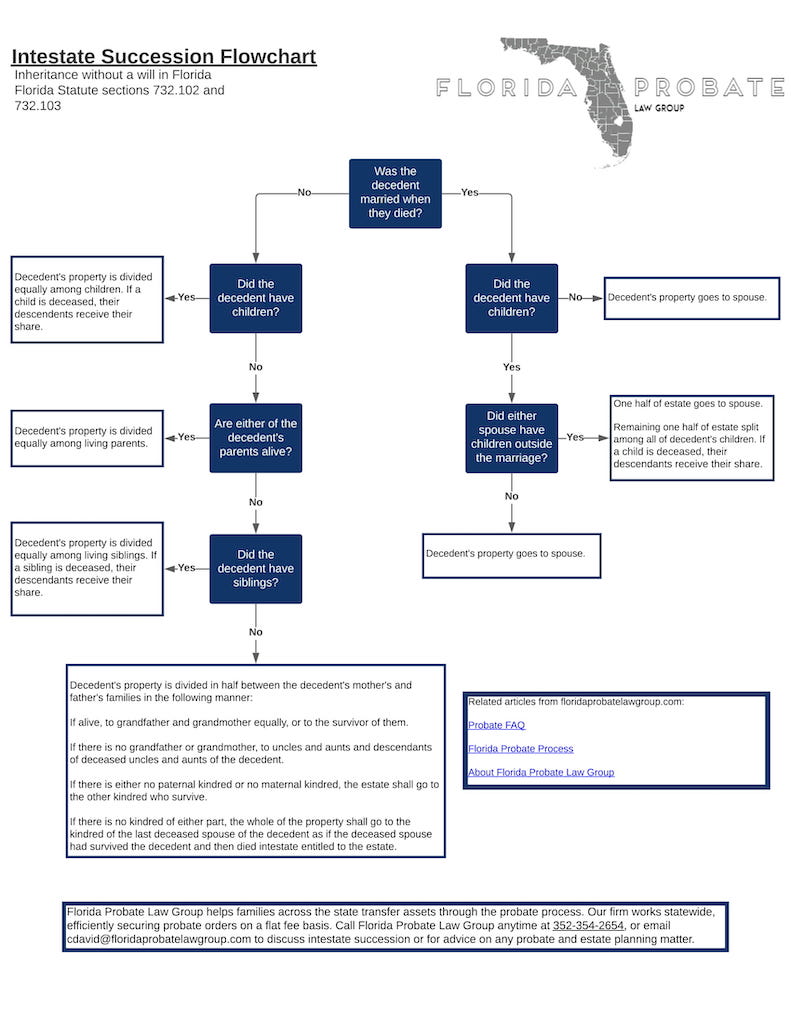

PROPERTY TAX BENEFITS FOR PERSONS 65 OR OLDER. The estate tax is a tax on an individuals right to transfer property upon your death. Florida law limits annual increases in property value.

And to find the amount due the fair market values of all the decedents assets as of death are. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. A Florida Property Tax Limit Amendment 3 initiative did not appear on the November 2 2010 ballot as a legislatively referred constitutional amendment.

Federal estate tax return. In all Florida counties except Miami-Dade the tax rate imposed on documents subject to tax is 70 cents on each 100 or portion thereof of the total consideration. But once you begin providing gifts worth.

Taxes on the federal return federal Form 706 is the amount of Florida estate tax due. Filing your taxes just became easier. If the estate is not required to file Internal Revenue Service IRS Form 706 or Form 706-NA the personal representative may need to file the Affidavit of No Florida Estate Tax Due Florida.

If any of the. Florida Form F-706 and payment are due at the same time the federal estate tax is due. The homestead exemption and Save Our Homes assessment.

Final individual state and federal income tax returns. Property owners in Florida may be eligible for exemptions and additional benefits that can reduce their property tax liability. No Florida estate tax is due for decedents who died on or after January 1 2005.

Florida Homestead Exemption How It Works Kin Insurance

Does Florida Have An Inheritance Tax Alper Law

Florida Homestead Advantages Estate Planning Attorney Gibbs Law Fort Myers Fl

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

Estate Tax And Gift Tax Changes Coming In 2022 Karp Law Firm

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

![]()

Does Florida Have An Inheritance Tax Alper Law

How Can I Avoid The Massachusetts Estate Tax Heritage Law Center

Should I Put My Florida Homestead In A Living Trust

Eight Things You Need To Know About The Death Tax Before You Die

Using A Florida Llc For Estate Planning Key Advantages Estate Planning Attorney Gibbs Law Fort Myers Fl

Florida Property Tax H R Block

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

Florida Estate Planning Guide Everything You Need To Know

Florida Homestead Exemption How It Works Kin Insurance

Does Florida Have An Inheritance Tax Alper Law

How Your Estate Is Taxed Or Not

How Is Tax Liability Calculated Common Tax Questions Answered